We are always looking for new talent!

Oxbury has been built for farmers and is backed by farmers. This ethos underpins everything we do, including our approach to recruiting new team members. We look for people with not only the right technical skills and knowledge, but for people who are passionate about supporting British farmers and agriculture.

From Product Development through to Customer Relationship Management, everyone in our business plays a vital role in supporting our farmers and helping to build a sustainable future for British food and farming.

Whether you are a new graduate embarking on your career or an experienced professional, if you have a passion for farming and agriculture, along with a background in banking and/or financial technology, we want to hear from you.

If you are interested, please email your CV to careers@oxbury.com.

What are some of the benefits of working at Oxbury Bank?

Whatever your role at Oxbury, you can be assured that you will have the opportunity to thrive in a fast-paced environment that will challenge and support you to be successful.

Displayed below are the type of benefits you can expect when working at Oxbury:

- Enhanced Annual Leave Entitlement

- Oxbury Award (Bonus Scheme)

- Private Medical Healthcare

- Employee Assistance Programme

- Life Insurance

- Pension Scheme

- Enhanced Maternity and Paternity Leave

- Company Share Options

- Employee Referral Scheme

Current Opportunities at Oxbury

The Product Manager plays a key role in the definition, development and launch of new products, and the management of existing products. Working alongside other Product team members to ensure the successful delivery and ongoing management of the suite of Oxbury products.

For more information and to apply, click here.

The CRM Analyst is responsible for supporting the business in managing and optimising customer relationship management (CRM) processes and systems. This role works closely with Product Delivery Leads and cross-functional teams to ensure CRM strategies align with business objectives, drive operational efficiency, and support data-driven decision making. The CRM Analyst will help maintain accurate customer data, streamline business processes, and ensure the CRM system is used effectively across the organisation.

For more information and to apply, click here.

Join our Online Banking team as we build the next generation of digital banking experiences for Britain's agricultural sector. You'll be working across our full stack—from crafting intuitive React interfaces to building robust APIs—while helping shape a platform that makes a real difference to farmers and rural businesses.

We're evolving our technology stack and moving towards modern frameworks and architectures. This means you'll have the opportunity to work with established systems while building new features using current best practices. If you enjoy solving real problems with clean code and want to see the direct impact of your work, this role offers exactly that.

For more information and to apply, click here.

Graduate and Placement Programme

Thank you for your interest in the Graduate and Student Placement programme at Oxbury Bank. Our roles will be made live on the 1st October 2025, you will then be able to begin your application.

When applying for the programme, you will need to submit your up to date CV and a cover letter by the 24th November 2025 to careers@oxbury.com. This will need to detail your experience, motivations and suitability for the programme you are most interested in.

If your application is successful, you will be invited to attend an initial interview, either online or in person. Selected candidates will then be invited to a final stage interview.

A Bachelor’s degree (or working towards) and a background in, or in-depth knowledge of farming or agriculture.

We look forward to hearing from you!

Current Opportunities at Oxbury for Graduates and Placement Students

The Relationship Associate will build personal relationships with internal Relationship Managers and our external introducer network to ensure we understand their customers businesses and meet their lending needs.

For more information and to apply, click here.

Oxbury’s IT function is central to the way we operate. From the outset, our business leaders and IT team have worked closely together to deliver an advanced banking platform that fulfils the unique requirements of our target market.

Our cloud native architecture is fully containerised and makes use of the latest serverless technologies to provide a performant and resilient solution. We have adopted best of breed technologies to implement future thinking features such as biometric authentication, advanced analytics and a self-healing microservices platform.

We are looking for a technology obsessed candidate to join our nascent IT graduate programme.

For more information and to apply, click here.

Oxbury’s Operations function is the engine of the bank ensuring that we meet and exceed our customers’ expectations.

A graduate placement in our Operations team can give you exposure to:

- Lending and savings customers.

- All our operating processes and input to them so we continually making them better.

- Interaction with our IT, Credit & Risk, Sales and Management Information departments – basically the whole bank!

- Involvement in product and process development especially within the User Acceptance Testing.

- Quality control and assurance.

- Opportunities to be involved in special projects.

- Early opportunities for Line Management.

We are looking for candidates who have the capacity and confidence to quickly understand work practices and implement them. A knowledge of banking is not essential as we can provide that, but candidates should be committed to undertake the training/reading necessary to understand the regulated environment for the financial industry and apply that knowledge to the processes and controls Oxbury has in place.

For more information and to apply, click here.

There are 4 cornerstones of the service that Oxbury provides to the farming community & rural economy: -

- Excellent customer service when executing tasks requested by the Bank or by the farmer customer, always completed in an efficient, polite and capable manor.

- Building personal relationships with our customer and professional partners to ensure we understand their business and meet their banking needs.

- Offering competitive savings and borrowing rates

- Secure online and mobile platforms that are intuitive and easy to use – allowing the farmer and distributor to self-service wherever possible.

The Agricultural Relationship Manager is predominantly customer facing. The role is a critical part of Oxbury’s customer service offering.

For more information and to apply, click here.

There are 4 cornerstones of the service that Oxbury provides to the farming community & rural economy: -

- Excellent customer service when executing tasks requested by the Bank or by the farmer customer, always completed in an efficient, polite and capable manor.

- Building personal relationships with our customer and professional partners to ensure we understand their business and meet their banking needs.

- Offering competitive savings and borrowing rates

- Secure online and mobile platforms that are intuitive and easy to use – allowing the farmer and distributor to self-service wherever possible.

The Agricultural Relationship Manager is predominantly customer facing. The role is a critical part of Oxbury’s customer service offering.

For more information and to apply, click here.

To activity contribute to the credit risk activities of Oxbury Bank. Ensure, where required, security is correctly held and provide support for compliance matters. Ensure that Oxbury lending is conducted on sound commercial and professional principles which place customers at the heart of its activities and achieves its defined corporate objectives whilst being underpinned by a framework of prudent and effective controls which enable risk to be assessed, managed and controlled.

For more information and to apply, click here.

To activity contribute to the credit risk activities of Oxbury Bank. Ensure, where required, security is correctly held and provide support for compliance matters. Ensure that Oxbury lending is conducted on sound commercial and professional principles which place customers at the heart of its activities and achieves its defined corporate objectives whilst being underpinned by a framework of prudent and effective controls which enable risk to be assessed, managed and controlled.

For more information and to apply, click here.

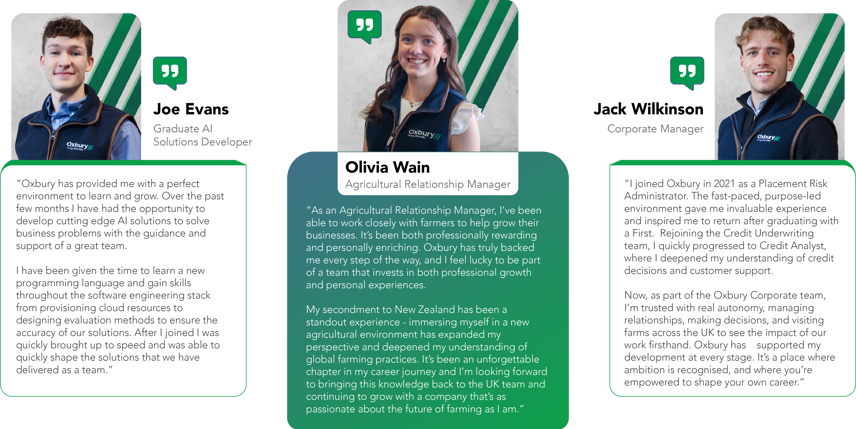

Find out what some of our graduate and placement students have to say!

How applicant data will be processed by Oxbury

Oxbury Bank Plc is aware of its obligations under the General Data Protection Regulation (GDPR) and current data protection legislation and is committed to processing your data securely and transparently. The following privacy notice sets out, in line with data protection obligations, the types of data that we collect and hold on you as a job applicant. It also sets out how we use that information, how long we keep it for and other relevant information about your data.